Personal Finance Online Course

CPD Accredited | Free PDF & Hard Copy Certificate included | Free Retake Exam | Lifetime Access

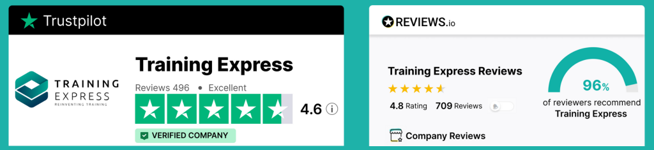

Training Express Ltd

Summary

- Digital certificate - Free

- Hard copy certificate - Free

- Exam(s) / assessment(s) is included in price

- Tutor is available to students

Add to basket or enquire

Overview

This Personal Finance Course will teach you everything you need to know about personal cash flow, money management, borrowing, credit and debt management. By enrolling in this course, you will also equip with the basic understanding of accounting and personal finance, importance of personal finance and how to manage personal insurance.

At the end of the Personal Finance course, you will get the knowledge of TAX and financial strategies in designing personal budget. You will also learn how to manage both the money and mental health.

Key Features:

- CPD Certified Personal Finance Course

- Instant e-certificate

- Fully online, interactive Personal Finance course with audio voiceover

- Developed by qualified professionals in the field

- Self-paced learning and laptop, tablet, smartphone-friendly

- 24/7 Learning Assistance

- Discounts on bulk purchases

CPD

Course media

Resources

- Training Express Brochure - download

Description

With the rising importance of financial literacy, demand for professionals proficient in Personal Finance is soaring in the UK, offering abundant job opportunities with salaries averaging £45,000 annually. The advantages of this Personal Finance course are multifaceted, empowering individuals to manage budgets, investments, and retirement planning effectively, fostering financial independence and stability in an uncertain economic climate.

Course Curriculum:

Personal Finance

- Module 01: Introduction to Personal Cash Flow

- Module 02: Understanding the Importance of Personal Finance

- Module 03: Accounting and Personal Finances

- Module 04: Cash Flow Planning

- Module 05: Understanding Personal Money Management

- Module 06: Borrowing, Credit and Debt

- Module 07: Managing Personal Insurance

- Module 08: Understanding Tax and Financial Strategies

- Module 09: Designing a Personal Budget

- Module 10: Personal Finance: Money and Mental Health

Learning Outcomes:

- Analyse personal cash flow for effective financial planning.

- Demonstrate understanding of key personal finance principles.

- Apply accounting techniques to manage personal finances efficiently.

- Develop strategies for prudent cash flow management.

- Implement effective money management practices for financial stability.

- Evaluate the impact of borrowing, credit, and debt on personal finances.

Accreditation

All of our courses, including the Personal Finance Course are fully CPD QS accredited, providing you with up-to-date skills and knowledge and helping you to become more competent and effective in your chosen field.

Certification

Once you’ve successfully completed your Personal Finance Course, you will immediately be sent your digital certificates. Also, you can have your printed certificate delivered by post (shipping cost £3.99).

Who is this course for?

This Personal Finance Online Course can be taken by anyone who wants to understand more about the topic. With the aid of this course, you will be able to grasp the fundamental knowledge and ideas. Additionally, this Course is ideal for:

- Recent graduates seeking financial literacy.

- Entrepreneurs aiming for fiscal responsibility.

- Individuals desiring enhanced financial acumen.

- Professionals looking to secure their financial future.

Requirements

Learners do not require any prior qualifications to enrol on this Personal Finance Online Course. You just need to have an interest in this Course.

Career path

After completing this Personal Finance Online Course you will have a variety of careers to choose from. The following job sectors of Personal Finance Online Course are:

- Personal Finance Advisor - £30K to 50K/year.

- Personal Finance Accountant - £25K to 45K/year.

- Insurance Broker - £20K to 40K/year.

- Tax Consultant - £25K to 50K/year.

- Credit Analyst - £25K to 45K/year.

Questions and answers

Currently there are no Q&As for this course. Be the first to ask a question.

Certificates

Digital certificate

Digital certificate - Included

Once you’ve successfully completed your course, you will immediately be sent a FREE digital certificate.

Hard copy certificate

Hard copy certificate - Included

Also, you can have your FREE printed certificate delivered by post (shipping cost £3.99 in the UK).

For all international addresses outside of the United Kingdom, the delivery fee for a hardcopy certificate will be only £10.

Our certifications have no expiry dates, although we do recommend that you renew them every 12 months.

Reviews

Currently there are no reviews for this course. Be the first to leave a review.

Legal information

This course is advertised on reed.co.uk by the Course Provider, whose terms and conditions apply. Purchases are made directly from the Course Provider, and as such, content and materials are supplied by the Course Provider directly. Reed is acting as agent and not reseller in relation to this course. Reed's only responsibility is to facilitate your payment for the course. It is your responsibility to review and agree to the Course Provider's terms and conditions and satisfy yourself as to the suitability of the course you intend to purchase. Reed will not have any responsibility for the content of the course and/or associated materials.